Did you know that children recover from a concussion at a slower pace than adults due to their developing brain?

Tips for Navigating the Concussion Confusion

4 Risk Management Tips to Protect YOUR County, City, Town or Village from Injury Liability

In New York, public parks are considered to be part of a local municipality's job of promoting the health and welfare of the general public.

To most insurance agencies, “claims” mean nothing more than having a few people to answer the phone and assist with claims reporting. Haylor, Freyer & Coon is not most insurance agencies. We truly invest in our claims service, advocating for customers, educating them and making an impact on the ultimate outcome of claims as you will see in the three unique case studies here:

The manufacturer of the EpiPen has been under fire recently for hefty price hikes on this widely used treatment of allergies. Is this a trend with the big drugmakers? What does this mean for your business and your family?

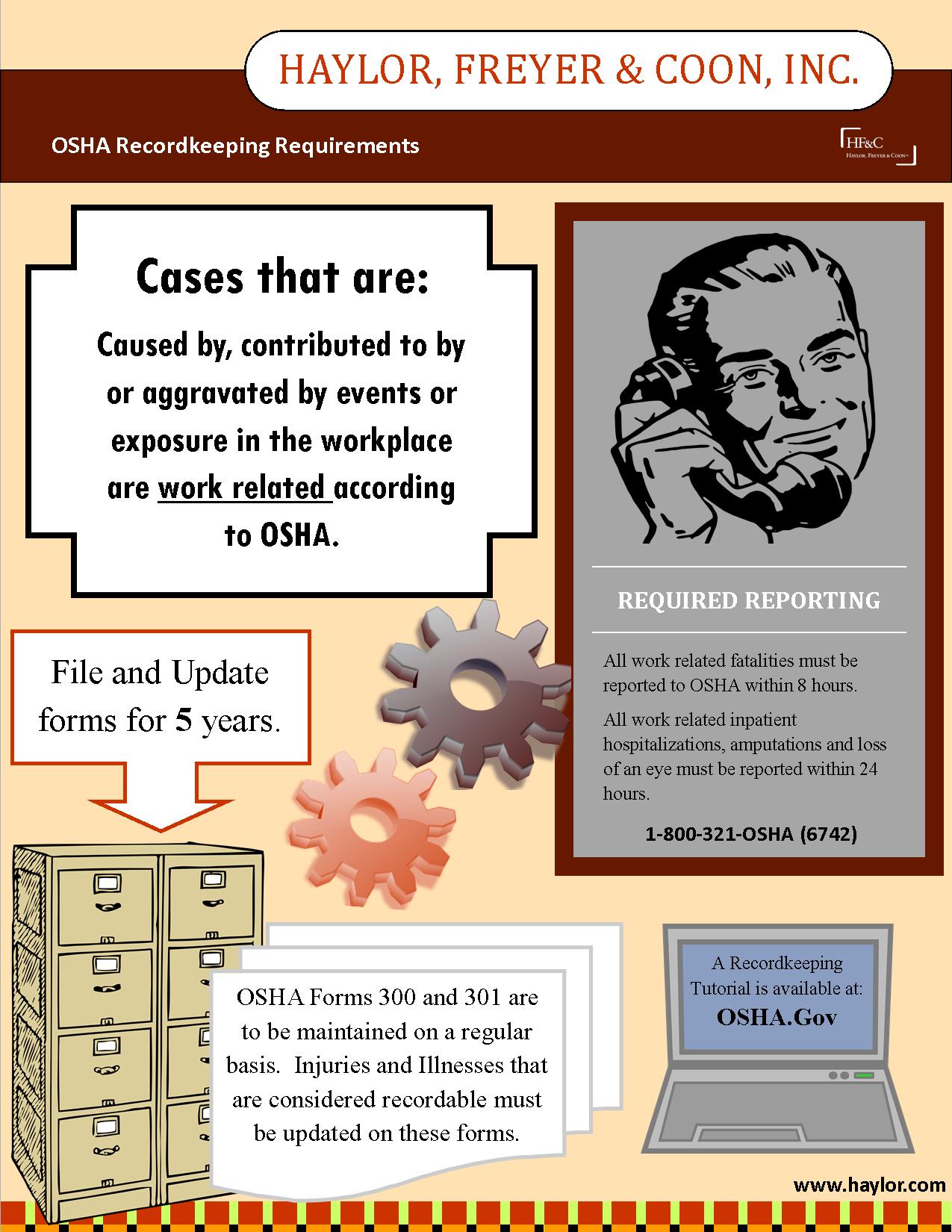

As a business, you may think that the need to report a work related injury, illness or death is only necessary for Workers Compensation. The truth is that the Occupational Safety and Health Administration (OSHA) is also on the ‘need to know’ list when it comes to certain reporting. According to the National Law Review "OSHA Electronic Recordkeeping Rule Creates Significant Reporting Requirements, Potential Enforcement Risks"

In the past, companies that employed fewer than 10 or those that are low risk such as an insurance office, were typically exempt from ongoing recordkeeping when it comes to on the job injury or illness. However, with the 2015 changes in policy, ALL businesses, regardless of size, need to report any work related hospitalizations, amputations or loss of eye to OSHA within 24 hours of the employer learning of the incident. If a death occurs on the job, this is to be reported to OSHA within 8 hours.

From farming to shipping industries, drone operators are putting their unmanned aircraft to a variety of uses. In fact, the drone market is expected to grow to $4.8 billion by 2021. With demand increasing, the need for drone insurance is also expected to intensify.

Topics: Drone

You have worked with architects for months on developing a blueprint for a new office building in town. The plans were approved and contractors have been hired, work on the construction site has begun and things are going well. During week 3 of construction you turn on the news to an alarming weather forecast. Your town is anticipated to see strong winds and rain for days. In that moment there is panic, you almost break into a sweat until you remember that you have purchased an insurance policy for this exact reason, to cover your damages and loss.

Avoiding the Void: 7 Tips to Decrease Work Related Injury

P

Work related injuries are not always preventable; there are however, ways in which we can decrease the number of incidents as well as lessen the impact that these injuries have on our employees, customers and overall business. On average, there are over 15,000 workplace injuries each year and many of these may have been prevented with proper training and Personal Protective Equipment (PPE). The Occupational Safety and Health Administration (OSHA) works hard to provide regulations and recommendations for a safe work experience. Failure to comply with OSHA standards could result in costly fines that could add up.

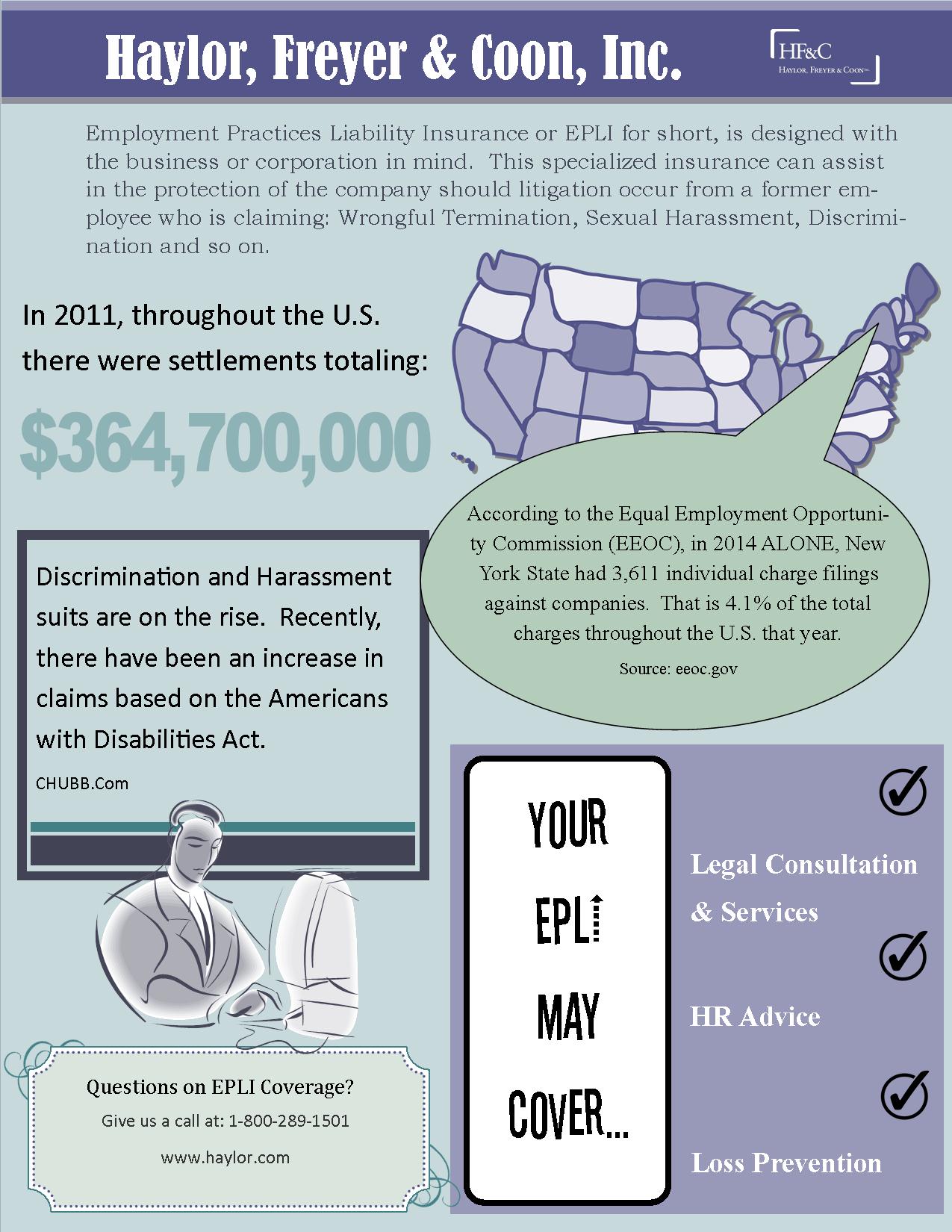

Why do I need Employment Practices Liability Insurance?

Employment Practices Liability Insurance

Owning a business can be very overwhelming at times. Hiring qualified personnel is very important when trying to build clientele or maintain reputation in your industry and /or the community. There are times when employees will clash or there may be issues with verbiage or an inappropriate touch. Your businesses could see a decrease in profit and need to reduce the workforce or terminate employment due to lack of productivity that even counseling cannot resolve. Decisions of this nature can be very difficult and can cause retaliation which could be very damaging if not handled legally and ethically. There are so many potential issues that have to do with the; hiring, firing, and maintenance of personnel that the need for Employment Practices Liability Insurance or EPLI is significant and well worth the cost.

Carbon Monoxide...are you compliant with the new laws?

Effective as of June 27, 2015, the State of New York enacted a law requiring carbon monoxide (CO) detection in all commercial facilities. The one year grace period for existing commercial buildings is rapidly approaching. Are you ready?