The manufacturer of the EpiPen has been under fire recently for hefty price hikes on this widely used treatment of allergies. Is this a trend with the big drugmakers? What does this mean for your business and your family?

According to the Wall Street Journal From May 2015 to May 2016, price margins for U.S. drug manufacturers rose by 9.8 percent. This is the second-highest increase among the 20 largest products and services monitored by the Bureau of Labor Statistics' Producer Price.

These operating margins are a good indication of how much of a company’s revenue is profit, and drug companies in general have hit 25 percent operating margins in the last year compared to 15.8 percent for companies in the Standard & Poor’s 500 index. More than two-thirds of the 20 biggest drug companies reported growing sales of their biggest products following price increases in the first quarter of 2016.

Rising drug costs are forcing tough decisions on those who foot the bill for much of American health care: employers and their employees. The pinch is most acute for the many large employers that are self-insured—hiring an insurance company to administer benefits but paying the bill themselves. “This is a tsunami,” said John Bennett, president and chief executive of Capital District Physicians’ Health Plan in Albany, N.Y., a nonprofit insurer with corporate clients. Pharmacy costs are “the single biggest driver of our medical inflation in the last few years.”

What can you do? Although we cannot control the drugmakers, there are things we can control: These three things can help control employer benefit expense.

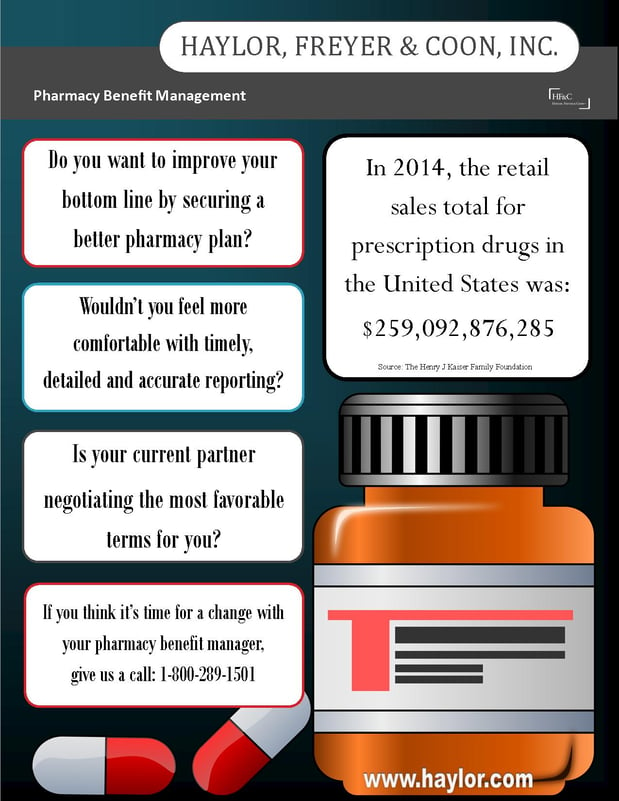

Haylor, Freyer & Coon, Inc. has been helping business, municipalities, schools, and not-for-profit's control their overall benefit expense with proactive solutions designed by listening and learning about your needs and concerns.

Contact us today for more information: Benefit Consultant