Understanding "Out-of-Band Verification" Clauses

The landscape of cyber insurance and the terms and conditions offered by providers are shifting. An increasingly common clause raising eyebrows is the "out-of-band verification" requirement. This stipulation, often buried within policy details, can significantly impact your coverage in case of cyberattacks like social engineering and funds transfer fraud.

Read More

Topics:

Breach,

Cyber,

Ransomware,

Hack,

Hacking,

Data,

Insurance,

Spear Phishing

Common Social Engineering Tactics to Watch For

Social engineering refers to a cyberattack method in which a cybercriminal preys on key human behaviors (e.g., trust of authority, fear of conflict and promise of rewards) to obtain unwarranted access to targets’ technology, systems, funds or data. These attacks can be deployed through various tactics, such as digital impersonation, deceitful messages or malicious software (known as malware). Social engineering attacks have become a significant threat to businesses of all sizes and sectors; after all, anyone can be targeted in these incidents—including entry-level workers, managers and CEOs. With this in mind, it’s crucial for businesses to be aware of frequently utilized social engineering methods and adopt effective cybersecurity measures to help mitigate these incidents. This article outlines common social engineering tactics to watch for and offers associated prevention and response tips.

Read More

Topics:

Cyber,

Ransomware,

Hack,

Hacking,

Spear Phishing

If you think all cyber insurance policies are the same, think again!

What may surprise you is that, unlike many other insurance policies you purchase, cyber policies don’t share any common policy forms. Each carrier custom tailors their insuring agreements that make up your policy. Technically, this is referred to as a “Named Perils” policy. The coverage only applies to what’s explicitly stated in the policy.

So why is this important? Many policyholders believe that when shopping for cyber insurance, as long as the limits match, the process is apples to apples. Unfortunately, that’s not the case. Policyholders (aka “insureds”) need to be hyper-aware that depending on the policy, coverage can change.

For example, cyber crime is often a reason for insureds to purchase coverage. Stories of Wire Transfer Fraud and ransomware are rampant for a good reason. According to the law firm BakerHostetler’s 2023 Data Security Incident Response Report (bit.ly/BakerHReport), the current year has experienced dramatically increased ransomware activity compared to 2022. Their research also has shown that ransomware accounts for 28% of all cyber incidents, with an average ransom payment of over $600,000 and significantly longer recovery times than in years past. Wire Transfer Fraud wasn’t far behind, accounting for 13% of incidents, with a median wire transfer loss of $97,044 and funds recovery on only 24% of all cases.

Read More

Topics:

Breach,

Cyber,

Ransomware,

Hack,

Data,

Spear Phishing

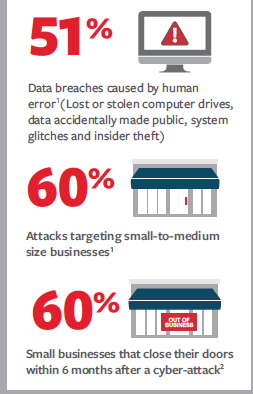

How do you protect your business from the m

assive increases in cyber attacks? These attacks present themselves in various forms.

Read More

Topics:

Breach,

Cyber,

Ransomware,

Hack,

Hacking,

Data,

Risk Management

The stakes are higher than ever for cyber incidents and ransomware attacks.

The pandemic has increased the fear and uncertainty and led to behavioral changes for many of us throughout this last year.

Read More

Topics:

Breach,

Cyber,

Hack,

Data,

Risk Management,

Cities, Towns, Village

As cyber-attacks continue to escalate in frequency and severity, you can’t afford NOT to protect your business from data breach. Criminals are constantly working on new ways to hack into your computer systems, steal data and create chaos.

Read More

Topics:

Breach,

Cyber,

Ransomware,

Hack,

Hacking,

Data