Please note: This new law, although mandatory for business of all size, provides that public employers may opt-in to the program.

Special Update: New York has enacted a paid family leave policy (known as the New York Paid Family Leave Benefits Law), to be phased into effect beginning on or after January 1, 2018, that will apply to employers of all business sizes. When the law is fully phased-in over the next several years, employees will be eligible for 12 weeks of paid, job-protected leave when certain life events occur.

Employee Eligibility Requirements

Under the new law, employees are generally eligible for paid family leave benefits after having worked for their employers for 26 or more consecutive weeks. "Family leave" is defined as leave taken by an employee from work:

- To participate in providing care, including physical or psychological care, for a family member (including a child, parent, grandparent, grandchild, spouse, or domestic partner) with a serious health condition;

- To bond after the birth or adoption of a child (including foster children, the children of a domestic partner, and stepchildren); or

- Due to any qualifying exigency arising out of the fact that the employee's spouse, domestic partner, child, or parent is on active military duty.

Amount of Leave

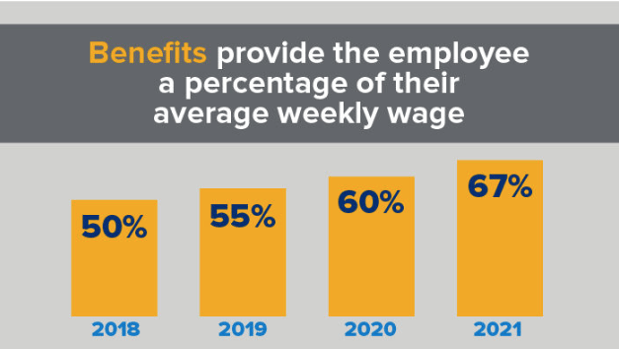

In general, the weekly benefit for family leave will be phased in as follows:

- On or after January 1, 2018, eligible employees will be entitled to up to 8 weeks of family leave in any 52-week period at 50% of their average weekly wage (capped at 50% of the state average weekly wage);

- On or after January 1, 2019, eligible employees will be entitled to up to 10 weeks of family leave in any 52-week period at 55% of their average weekly wage (capped at 55% of the state average weekly wage);

- On or after January 1, 2020, eligible employees will be entitled to up to 10 weeks of family leave in any 52-week period at 60% of their average weekly wage (capped at 60% of the state average weekly wage); and

- On or after January 1 of each succeeding year, eligible employees will be entitled to up to 12 weeks of family leave in any 52-week period at 67% of their average weekly wage (capped at 67% of the state average weekly wage).

Employee Protections An employer must maintain an employee’s group health plan benefits for the duration of paid family leave as if the employee had continued to work. Additionally, an employee may not lose any benefits accrued during employment prior to taking family leave.

Employer Notice Requirements & Possible Penalty Employers will be required to conspicuously post a notice in the workplace to indicate their compliance with the paid family leave requirements. In addition, employers must provide employees who take eight or more consecutive days of family leave with a written notice of their rights under the paid family leave law.An employer that fails to comply with the requirements of the paid family leave law is guilty of a misdemeanor and may face penalties, including fines and imprisonment.

Leave for AdoptionNew York law (Labor Law Section 201-c) requires private employers who permit employees to take a leave of absence for the birth of a child to grant the same leave (on the same terms) to employees for the adoption of a child. However, such employee is not entitled to equal child care leave at any time after the adoptive child reaches the minimum age for public school attendance, unless the adopted child is a hard-to-place or handicapped child under the age of 18 (as determined pursuant to state law).

6 things to do now:

- Set up your payroll for proper collection of employee contributions. It appears that the deduction will be $0.70 per employee per week, beginning July, 2017, but that detail will be finalized no later than June 1, 2017.

- Supply NYS Workers' Comp benefit coverage and claim filing details (not released yet) to all employees

- Add Paid Family Leave to your handbook, update all information

- Post the NYS notice (not released yet)

- Inform employees that when possible, they must give 30 day notice to take PFL

- Contact a Benefit Consultant at Haylor, Freyer & Coon, Inc. to discuss what insurance products are available to assist with this new state mandated benefit.